Decoding Fed Rate Hikes: A Business Owner’s Concise Guide

Decoding the Latest Federal Reserve Interest Rate Adjustments: A Business Owner’s Guide is crucial for understanding the economic landscape. These adjustments impact borrowing costs, investment decisions, and overall business strategies for owners in the US.

As a business owner in the US, staying informed about the Federal Reserve’s decisions is paramount. Recent adjustments to interest rates can significantly impact your business’s financial health and strategic planning. This article aims to provide clarity and actionable insights on decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide to navigating these changes.

Understanding the Federal Reserve’s Role

The Federal Reserve, often called the Fed, plays a pivotal role in the US economy. It’s essential to understand its functions to grasp the implications of its interest rate decisions.

What is the Federal Reserve?

The Federal Reserve is the central banking system of the United States. Established in 1913, its primary mission is to promote monetary stability and maximize employment.

Key Functions of the Fed

The Fed has several critical responsibilities, including setting monetary policy, supervising and regulating banks, and maintaining the stability of the financial system. It influences economic conditions by adjusting the federal funds rate, which affects borrowing costs throughout the economy.

- Controlling Inflation: The Fed aims for stable prices, typically targeting a 2% inflation rate.

- Promoting Employment: It seeks to maximize employment levels consistent with price stability.

- Ensuring Financial Stability: The Fed acts as a lender of last resort to prevent financial crises.

Understanding these functions is the first step in decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide. By monitoring the Fed’s actions and statements, business owners can anticipate potential economic shifts and adjust their strategies accordingly.

In conclusion, the Federal Reserve’s role is multifaceted, but its impact on interest rates is particularly relevant for business owners. Keeping abreast of the Fed’s activities can help businesses make informed decisions and prepare for economic changes effectively.

How Interest Rate Adjustments Affect Your Business

Changes in interest rates can have a ripple effect throughout your business. It’s imperative to understand how these adjustments influence various aspects of your operations.

Impact on Borrowing Costs

When the Federal Reserve raises interest rates, borrowing becomes more expensive. This affects your ability to secure loans for expansion, equipment purchases, or working capital. Conversely, lower interest rates can make borrowing more affordable.

Effects on Consumer Spending

Interest rate adjustments also impact consumer behavior. Higher rates can reduce consumer spending as borrowing becomes less attractive for big-ticket items like cars and homes. Lower rates, on the other hand, can stimulate spending.

Investment and Expansion Decisions

The cost of capital directly influences investment decisions. Higher interest rates can make investment projects less attractive, potentially delaying or canceling expansion plans. Lower rates can encourage investment and growth.

- Inventory Management: Interest rates affect the cost of holding inventory.

- Capital Expenditures: Higher rates increase the payback period for large investments.

- Pricing Strategies: Understanding consumer spending habits helps you set competitive prices.

Effectively decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide requires a thorough understanding of these interconnected factors. Monitoring these impacts can help you make informed decisions and mitigate potential risks.

Business owners must closely monitor these interconnected factors when decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide. By understanding these effects, you can make informed decisions and implement strategies to mitigate potential risks.

Analyzing Recent Federal Reserve Actions

Staying up-to-date with the Federal Reserve’s latest actions is crucial for making informed business decisions. Let’s delve into recent adjustments and what they signal.

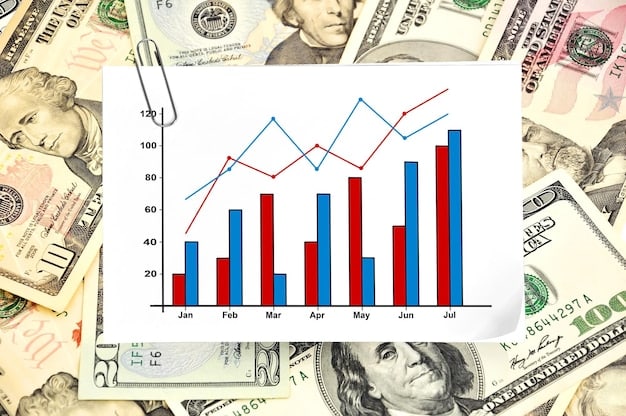

Overview of Recent Rate Adjustments

In recent months, the Federal Reserve has implemented several interest rate adjustments in response to economic conditions such as inflation and employment rates. Understanding the magnitude and frequency of these adjustments is essential.

Rationale Behind the Adjustments

The Fed’s decisions are driven by a complex interplay of economic data. Factors like inflation readings, unemployment figures, and GDP growth influence their monetary policy decisions. It’s crucial to understand the rationale behind these adjustments to anticipate future actions.

Key Economic Indicators to Watch

To effectively decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide, keep a close watch on key economic indicators. These indicators provide insights into the Fed’s future actions.

- Inflation Rate: Monitor the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index.

- Unemployment Rate: Pay attention to the monthly unemployment reports released by the Bureau of Labor Statistics.

- GDP Growth: Track the quarterly GDP growth figures to assess the overall health of the economy.

By monitoring these indicators and understanding the Fed’s rationale, you can better anticipate future interest rate adjustments and prepare your business accordingly.

Regularly analyzing Federal Reserve actions and understanding the underlying economic factors is essential for business owners. This knowledge enables you to make informed decisions and adapt your strategies to navigate economic changes effectively, especially when decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide.

Strategies for Adapting to Interest Rate Changes

Adapting to interest rate changes requires a proactive approach and a well-thought-out strategy. There are several ways to prepare your business for these fluctuations.

Refinancing Debt

Consider refinancing your existing debt to take advantage of lower interest rates or to secure more favorable terms. This can reduce your monthly payments and improve your cash flow.

Building Cash Reserves

Maintaining a healthy cash reserve can provide a buffer against unexpected increases in borrowing costs. This financial cushion allows you to weather economic uncertainties without relying heavily on debt.

Optimizing Pricing Strategies

Adjust your pricing strategies to reflect changes in consumer spending habits. If interest rates rise and consumer spending declines, consider offering promotions or discounts to maintain sales volume.

- Cost-Cutting Measures: Identify areas where you can reduce expenses without sacrificing quality.

- Diversifying Revenue Streams: Explore new markets or product lines to reduce reliance on a single source of income.

- Negotiating with Suppliers: Seek better terms with your suppliers to lower your costs.

Effectively decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide involves implementing these strategies and adapting them to your specific business needs. This proactive approach can help you mitigate risks and capitalize on opportunities.

By implementing these strategies, businesses can better navigate the challenges posed by interest rate fluctuations. Staying proactive and adaptable is key to maintaining financial stability and achieving long-term success when decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide.

Long-Term Financial Planning in a Changing Rate Environment

Long-term financial planning is essential for navigating a fluctuating interest rate environment. Creating a resilient financial strategy can help your business thrive regardless of economic conditions.

Developing a Flexible Budget

Create a budget that can adapt to changing interest rates. This involves identifying fixed and variable costs and adjusting your spending accordingly. A flexible budget allows you to respond quickly to economic shifts.

Scenario Planning

Conduct scenario planning to assess the potential impact of different interest rate scenarios on your business. This involves creating financial models that project your revenue, expenses, and cash flow under various economic conditions.

Investing in Efficiency

Invest in technologies and processes that improve efficiency and reduce costs. This can help you maintain profitability even when interest rates rise and consumer spending declines.

- Diversifying Investments: Spread your investments across different asset classes to reduce risk.

- Seeking Professional Advice: Consult with financial advisors who can provide expert guidance on managing your finances.

- Regularly Reviewing Financial Statements: Monitor your financial performance closely to identify potential issues and opportunities.

Smart long-term financial planning is crucial for businesses facing changing interest rates. A good understanding of decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide enables businesses to make sound financial plans for the future.

By implementing these strategies, you can create a resilient financial plan that helps your business weather economic uncertainties and achieve long-term success. Effective long-term planning is a critical component of decoding the latest Federal Reserve interest rate adjustments: A business owner’s guide.

| Key Point | Brief Description |

|---|---|

| 📈 Interest Rate Impact | Affects borrowing costs, consumer spending, and investment decisions. |

| 💰 Cash Reserves | Maintaining cash reserves provides a buffer against rate hikes. |

| 📊 Economic Indicators | Monitor CPI, unemployment rate, and GDP for future Fed actions. |

| 🔄 Debt Refinancing | Explore refinancing options to secure favorable terms. |

Frequently Asked Questions

The Federal Reserve influences interest rates, which subsequently affect your borrowing costs, consumer demand, and overall economic stability. Understanding these dynamics is critical for financial planning.

Monitor inflation rates (CPI), unemployment figures, and GDP growth to anticipate potential shifts in monetary policy. These indicators provide insight into the Fed’s likely actions.

Consider refinancing debt, building cash reserves, optimizing pricing strategies, and cutting costs to mitigate the negative impacts of rising interest rates on your business.

Develop a flexible budget, conduct scenario planning, invest in efficiency, diversify investments, and seek professional financial advice to weather economic uncertainties.

Refer to the Federal Reserve’s official website, reputable financial news outlets, and economic analysis reports for accurate and up-to-date information on monetary policy decisions.

Conclusion

Understanding and adapting to Federal Reserve interest rate adjustments is crucial for the success of US businesses. By monitoring key economic indicators, implementing proactive strategies, and making informed financial decisions, business owners can navigate these changes and thrive in a dynamic economic environment.