Breaking: Social Security Benefits to Increase by 8.7% in 2025 – What to Expect

Breaking: Social Security benefits are set to increase by 8.7% in 2025, marking a significant adjustment to help offset the impact of inflation on retirees and other beneficiaries. This increase will provide much-needed financial relief to millions of Americans.

Are you a Social Security beneficiary wondering how the rising cost of living will affect your payments? The Social Security Administration (SSA) has announced that Breaking: Social Security benefits to increase by 8.7% in 2025, offering a substantial boost to millions of Americans.

This significant adjustment aims to help individuals keep pace with inflation and maintain their purchasing power. Read on to discover how Breaking: Social Security Benefits to Increase by 8.7% in 2025 – How Much More Will You Receive? and what this means for you.

Breaking: Social Security Benefits Increase in 2025 – Overview

The upcoming year is bringing good news for Social Security recipients. The cost-of-living adjustment (COLA) will be 8.7%, leading to higher monthly payments starting in January 2025. This increase addresses the rising expenses beneficiaries face due to inflation.

Understanding the COLA

COLA, or Cost of Living Adjustment, is crucial for protecting the financial well-being of Social Security beneficiaries. This adjustment helps to ensure that benefits keep pace with inflation, thus maintaining the purchasing power of retirees and other recipients. Without COLA, benefits could erode over time, leaving individuals struggling to afford basic necessities.

The Social Security Administration (SSA) calculates COLA based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures the average change over time in the prices paid by urban wage earners and clerical workers for a market basket of consumer goods and services.

- CPI-W: The Consumer Price Index for Urban Wage Earners and Clerical Workers reflects inflation.

- Annual Adjustment: The COLA is typically announced in October of each year.

- Impact on Beneficiaries: Higher COLA means increased monthly payments, providing financial relief.

The COLA is an essential component of Social Security. Breaking: Social Security benefits to increase by 8.7% in 2025 is due to a significant rise in the CPI-W over the past year. This adjustment serves as a lifeline for those who depend on Social Security to cover their living expenses, offering peace of mind in times of economic uncertainty.

How Much More Will You Receive?

Wondering what the Breaking: Social Security Benefits to Increase by 8.7% in 2025 – How Much More Will You Receive? This section provides a breakdown of how the COLA impacts different benefit levels and how beneficiaries can estimate their increase.

To determine the precise increase, you can multiply your current monthly benefit amount by 0.087 (which represents 8.7%). The result will be the additional amount you can expect to receive each month starting in January 2025.

Estimating Your Increase

To estimate your increase, consider these factors: your current benefit amount, any deductions for Medicare premiums, and potential tax implications. Understanding these factors can provide a clearer picture of the financial impact of the adjustment.

- Current Benefit Amount: This is the most important factor.

- Medicare Premiums: These are often deducted from Social Security benefits.

- Tax Implications: Social Security benefits may be subject to federal and state income taxes depending on your overall income level.

For example, if your current monthly benefit is $1,500, multiplying that amount by 0.087 results in an increase of $130.50 per month. However, if you have Medicare premiums deducted, that amount will reduce the net increase you experience.

Who Will Benefit the Most?

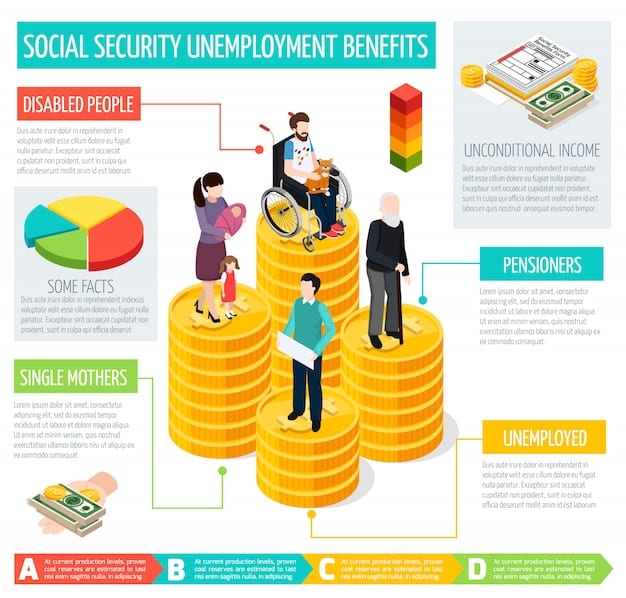

The Breaking: Social Security Benefits to Increase by 8.7% in 2025 is not uniform across the board. Certain groups of beneficiaries may see a more significant impact due to their specific circumstances. Understanding who benefits the most can help you gauge the importance of this COLA for various individuals.

The increase primarily benefits retirees, disabled individuals, and survivors who rely on Social Security as a major source of income. Those with lower benefit amounts typically see a larger proportionate increase in their overall income.

Impact on Different Groups

Considering the impact on different groups is essential for a comprehensive understanding. Here is a closer look at how various beneficiaries are affected by the increased benefits.

Those with lower incomes often depend more heavily on Social Security to meet their basic needs. As a result, a substantial increase in monthly benefits can have a transformative effect on their financial stability. These individuals often spend a larger portion of their income on essential expenses such as housing, food, and healthcare. Any extra financial support can significantly ease their financial strain.

Conversely, individuals with higher incomes, even those receiving maximum Social Security benefits, also benefit from the COLA. While the percentage increase is the same, the slightly higher dollar amount could still contribute to their financial security.

Long-Term Implications of the Increase

While the Breaking: Social Security Benefits to Increase by 8.7% in 2025 provides immediate relief, it also has potential long-term implications for both beneficiaries and the Social Security system as a whole. Understanding these implications is key to planning for the future.

Sustainability of Social Security

One of the critical aspects to consider is how the increased payments affect the sustainability of Social Security in the long term. Some experts are concerned that higher COLAs, particularly during periods of high inflation, could strain the Social Security Trust Funds.

- Trust Fund Impact: Higher payouts could accelerate the depletion of trust fund reserves.

- Demographic Factors: The increasing number of retirees relative to workers contributes to the challenge.

- Policy Adjustments: Potential changes to the retirement age or benefit formulas may be considered.

To ensure the longevity of Social Security, policymakers may need to consider adjustments to the system. These could include raising the retirement age, modifying benefit formulas, or increasing payroll taxes. Such changes could alleviate financial pressure and secure the future of Social Security for generations to come.

Planning Ahead with the Increased Benefits

Receiving the Breaking: Social Security Benefits to Increase by 8.7% in 2025 requires careful planning to maximize its benefits. Budgeting, financial advising, and healthcare considerations become even more important.

Begin by reassessing your budget to account for the increased monthly income. Determine whether to allocate the extra funds towards essential expenses, savings, or discretionary spending.

Financial Planning Tips

Here are practical financial planning tips to consider:

Seek advice from a qualified financial advisor who can help you navigate your financial situation and make informed decisions. A financial planner can offer personalized guidance on investment strategies, retirement planning, and potential tax implications.

Be mindful that Social Security benefits could be subject to federal and potentially state income taxes, depending on your overall income level. Consult with a tax professional to understand how the increased benefits may affect your tax obligations.

| Key Point | Brief Description |

|---|---|

| 🎉 8.7% Increase | Social Security benefits will increase by 8.7% in 2025. |

| 💰 COLA Impact | COLA will help beneficiaries offset inflation. |

| 📈 Long-Term Planning | Consider financial planning to maximize benefits. |

| 🩺 Healthcare | Review healthcare coverage and costs with increase. |

Frequently Asked Questions

The increase is primarily due to the need to adjust for the rising cost of living. The cost-of-living adjustment (COLA) is designed to help Social Security benefits keep pace with inflation, which has been noticeably high.

The COLA is calculated based on the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index reflects the average change over time in the prices paid by urban wage workers.

Most Social Security beneficiaries, including retirees, disabled individuals, and survivors, are eligible for the increased benefits. Some exceptions may apply to those with specific circumstances or benefit adjustments.

The increased payments will typically begin in January 2025. The exact date may vary based on your payment schedule and banking institution but expect to see your updated payment in January.

Depending on your income level, the increased benefits could potentially affect your tax obligations. Contact a tax professional to estimate whether the additional income will affect your overall tax situation.

Conclusion

In conclusion, the Breaking: Social Security Benefits to Increase by 8.7% in 2025 – How Much More Will You Receive? offers vital support to beneficiaries amidst rising living costs. This significant adjustment underscores the importance of Social Security in providing a safety net for millions of Americans.

Planning ahead, understanding financial implications, and getting updated healthcare information will enable you to leverage these increased benefits effectively. Stay informed about changes to Social Security so you can secure your financial future.