Breaking: Oil Prices Surge After Conflict – What It Means for You

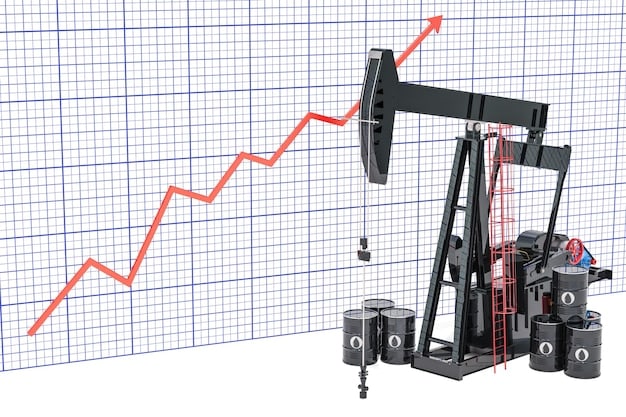

Breaking: Oil Prices Surge After International Conflict – Expect Higher Gas Prices Soon. This surge is poised to impact consumers significantly, potentially leading to increased costs across various sectors beyond just gasoline.

The global economy is bracing for impact as breaking: Oil Prices Surge After International Conflict – Expect Higher Gas Prices Soon. This sudden increase is sending ripples through markets worldwide, and consumers in the US are likely to feel the pinch at the pump very soon.

Understanding the Immediate Impact of the Conflict on Oil Markets

The escalation of international tensions has directly impacted global oil supply chains, triggering a rapid increase in crude oil prices. This disruption stems from concerns over potential supply shortages and the instability in key oil-producing regions.

How Conflict Affects Oil Supply

International conflicts often lead to disruptions in oil production and distribution, impacting global supply. Several factors contribute to this instability:

- Production Disruptions: Active conflict zones can experience damage to oil infrastructure, halting or reducing production capacity.

- Sanctions and Trade Restrictions: Political measures imposed on involved nations can limit their ability to export oil, thus tightening global supply.

- Increased Shipping Costs: Instability raises insurance and security costs for oil tankers, adding to the price of transporting oil.

The combination of these factors creates a volatile environment where anxieties about future supply amplify price increases. Market speculation further exacerbates these fluctuations, making it essential for consumers and businesses to stay informed.

In summary, the interplay between conflict, supply disruptions, and market speculation significantly drives oil price volatility. This volatility subsequently results in higher gas prices for consumers and increased operational costs for businesses worldwide.

The Ripple Effect: Gas Prices and Beyond

The immediate impact of rising oil prices is evident at gas stations across the US, where consumers are starting to see higher prices per gallon. However, the consequences extend far beyond just gasoline.

The Broader Economic Impact

Higher oil prices have a cascade effect on various sectors of the economy:

- Transportation: Increased fuel costs mean higher prices for transportation services, including trucking, airlines, and public transit.

- Manufacturing: Many manufacturing processes rely on oil-based products and energy. Increased costs can lead to higher prices for consumer goods.

- Agriculture: Farming requires significant fuel for machinery and transportation of produce. Rising costs can affect food prices.

These factors contribute to inflationary pressures, potentially affecting the overall cost of living. Consumers may experience decreased purchasing power, and businesses might face challenges in maintaining profitability.

Consequently, understanding the far-reaching effects of breaking: Oil Prices Surge After International Conflict – Expect Higher Gas Prices Soon is essential for both households and businesses. Adapting to these changes requires strategic planning and awareness of the interconnectedness of oil prices with various economic sectors.

Expert Analysis: Why This Surge Is Different

Industry experts are closely monitoring the current situation, pointing out unique factors that differentiate this oil price surge from previous events. These include the specific geopolitical context, existing supply chain vulnerabilities, and long-term market trends.

Geopolitical Factors Contributing to Volatility

The nature of the international conflict plays a significant role. Consider these elements:

- Strategic Importance: If conflict zones are located near major oil pipelines or shipping routes, the impact on supply is magnified.

- Political Stability: Uncertainty about the duration and outcome of the conflict increases market anxiety.

- International Relations: The involvement of major oil-producing nations in the conflict can lead to complex supply dynamics.

Experts emphasize that these geopolitical factors create a more unpredictable situation, making it challenging to forecast long-term price trends. Ongoing analysis is essential to understanding the potential implications.

Overall, the current surge in oil prices is distinct due to the convergence of geopolitical tensions, supply chain vulnerabilities, and evolving market trends. This complexity requires careful analysis and proactive management to mitigate potential economic impacts.

Mitigating the Impact: Strategies for Consumers and Businesses

As consumers and businesses face the prospect of higher gas and energy prices, adopting proactive strategies can help mitigate the financial impact. These strategies range from energy conservation to strategic investments.

Practical Steps for Consumers

Several steps can be taken to reduce household energy consumption and transportation costs:

- Optimize Driving Habits: Reduce speeding, avoid aggressive acceleration, and maintain proper tire inflation.

- Conserve Energy at Home: Use energy-efficient appliances, adjust thermostats, and seal drafts to reduce heating and cooling costs.

- Explore Alternative Transportation: Consider carpooling, public transportation, biking, or walking for shorter commutes.

By implementing these measures, households can significantly reduce their energy expenses and lessen the impact of breaking: Oil Prices Surge After International Conflict – Expect Higher Gas Prices Soon.

Long-Term Implications and Alternative Energy Solutions

The current oil price surge underscores the importance of long-term energy diversification and the development of alternative energy solutions. Investing in renewable energy sources and reducing reliance on fossil fuels can provide greater energy security and stability.

The Role of Renewable Energy

Renewable energy sources offer a viable alternative to traditional fossil fuels:

- Solar Power: Advances in solar technology have made it more affordable and efficient, providing a cleaner energy source.

- Wind Energy: Wind farms continue to expand, contributing a significant portion of energy production in many regions.

- Electric Vehicles: The transition to electric vehicles can reduce dependence on gasoline and lower transportation costs over time.

These long-term solutions not only mitigate the impact of oil price volatility but also contribute to a more sustainable and environmentally friendly energy future.

| Key Point | Brief Description |

|---|---|

| ⛽ Gas Price Surge | Prices are rising due to international conflict impacting oil supply. |

| ✈️ Economic Ripple | Impact extends to transportation, manufacturing, and agriculture sectors. |

| 💡 Mitigation Tips | Optimize driving, conserve energy at home, and explore alternatives. |

| ⚡ Renewable Focus | Invest in solar, wind, and EVs for long-term energy stability. |

FAQ

The primary reason for the surge in gas prices is the international conflict disrupting global oil supply chains, leading to increased market uncertainty and higher crude oil prices.

Conflicts often disrupt oil production and distribution due to damaged infrastructure, trade restrictions, and increased shipping costs, all of which contribute to higher prices.

Consumers can optimize driving habits, conserve energy at home, and explore alternative transportation options to reduce their fuel consumption and overall expenses.

Yes, investing in renewable energy sources like solar and wind power, as well as transitioning to electric vehicles, can reduce dependence on fossil fuels and provide greater energy security.

This surge is distinct due to the specific geopolitical context, existing supply chain vulnerabilities, and long-term market trends converging to create a more unpredictable and complex situation.

Conclusion

In conclusion, the breaking: Oil Prices Surge After International Conflict – Expect Higher Gas Prices Soon presents immediate challenges for consumers and the global economy. Understanding the causes and implementing mitigation strategies is crucial for navigating this volatile period.